If you don’t know where you are, how can you know where you are headed?

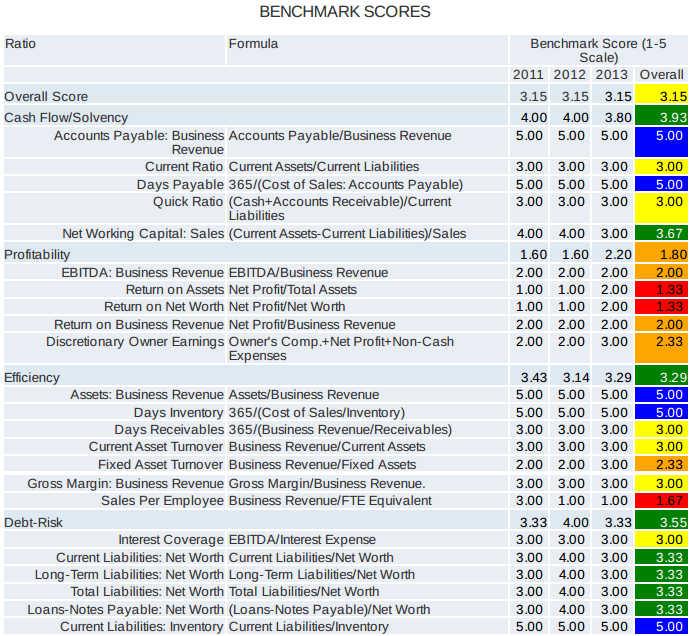

Benchmarking your company against your industry peers helps you identify your strengths and weaknesses. It points you in the direction to increase the value of your company.

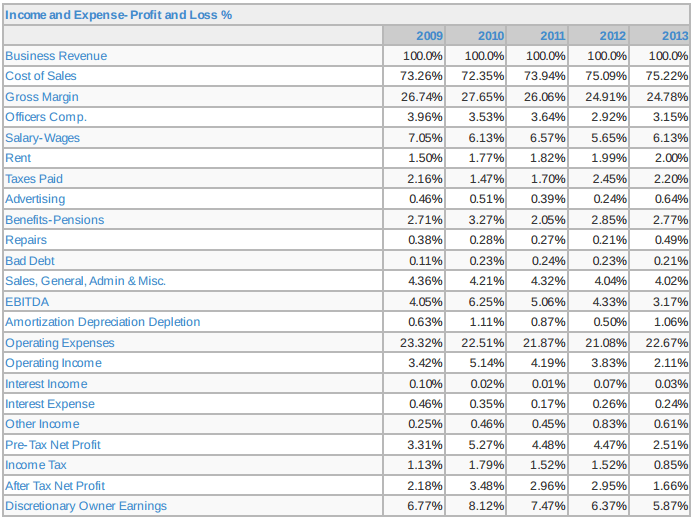

Benchmarking your company using common-sized income statements and balance sheets is the single most important you can do to understand the value and salability of your company. We use common-sized financial statements in all our engagements, including M&A, valuation, capital raising and turnarounds. They quickly tell us where a company ranks compared to competitors.

“Common-sizing” is taking a financial statement and putting the number in percentages. In the case of the income statement, you take each line item and cast it as a percentage of sales. In this way, you can see at a glance how each expense category compares to sales. By putting your data year-by-year, you can easily detect changes and trends. Graphing the data makes the changes all that more clear. With this in hand, you can determine if you have a competitive advantage or disadvantage.

“Competitive Advantage” is technically defined as a 2 point advantage in EBITDA margin (Earnings Before Interest, Taxes, and Depreciation as a percentage of sales) compared to industry averages, e.g. 10% versus 8% industry average. There are vast differences in the EBITDA margins of companies, and between the various industries and company sizes. You always want to compare yourself to your industry. You may or may not want to compare yourself to just companies of your comparable size, as you are usually competing against the largest players unless you have geographical – or other – barriers to entry.

Your EBITDA margin advantage (or disadvantage) tells us where a company would fall in the comparable sales transaction EBITDA multiple observations, ceterus paribus. If a company’s industry comps show that companies in its space have fetched multiples of 4-10x EBITDA with an average of 6x, and the company’s EBITDA margins are 2 points better than industry average, we expect that this company would sell at the high end of the EBITDA multiple range.

This outcome results in a higher sale price at any given nominal dollar EBITDA level. Keeping an EBITDA margin advantage is mission critical if you want a good sale price. The buyer can ill afford to scale up a company that is just average, or worse, below average. It only makes sense to scale up a company that is superior to its peers.

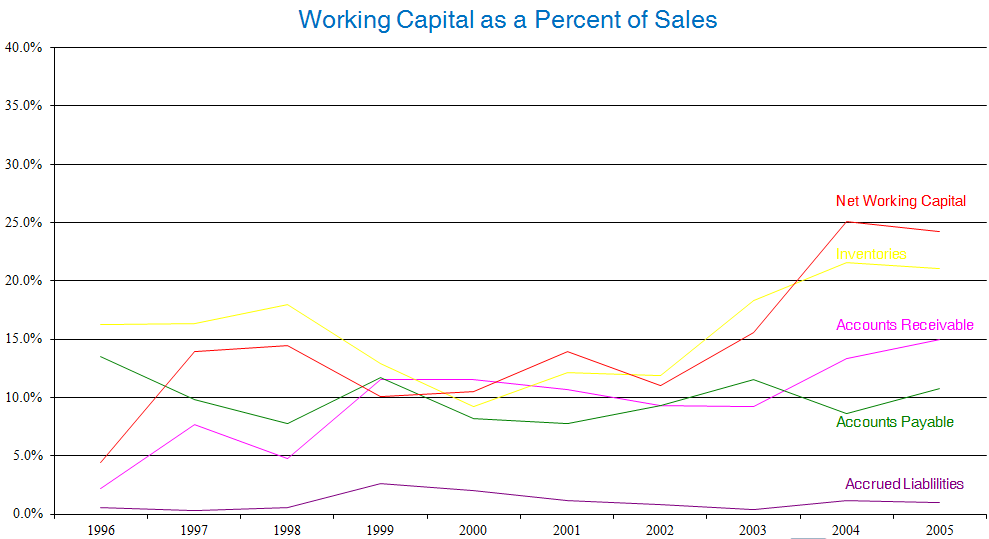

Benchmarking goes well beyond the income statement, however. We use common sized income statements to look at working capital efficiency. Here, we calculate receivables, inventory, payables and accruals as a percent of sales. If we see rising percentages over time, it is a cause for alarm. We saw this trend prior to the financial crisis in the building products sector. The underlying cause was the slowing of payments by home builders to their suppliers.

An out of control working capital increase that makes growth infeasible.

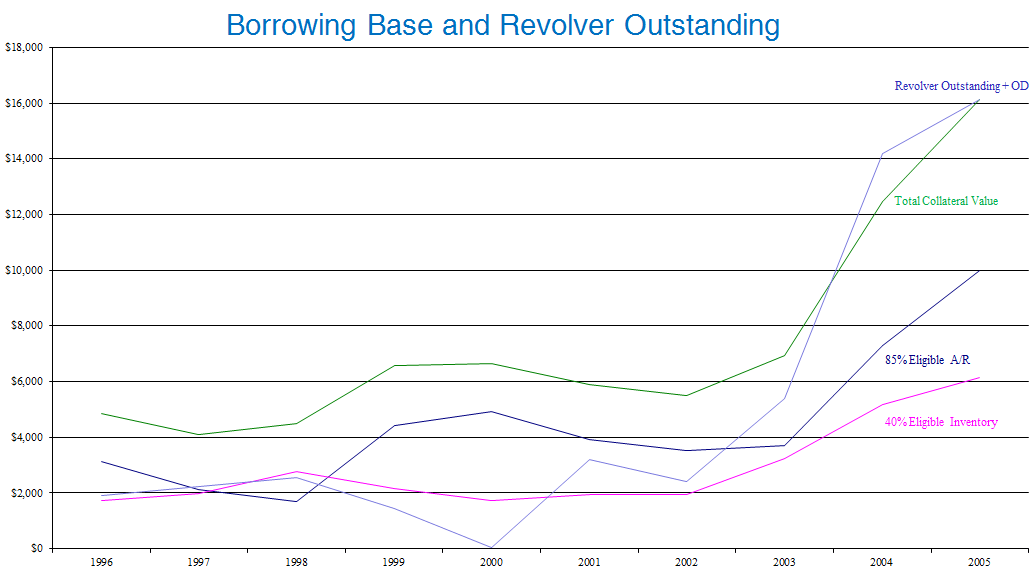

We also saw a disconcerting increase in working capital utilization by a manufacturer in the building products space. The long term trends indicated that continued revenue growth would not be financeable and that the company was headed towards a liquidity problem. This company listened to us, and accepted an offer to be acquired by a much larger competitor.

Revolver availability tapped out due to unconstrained increases in working capital.

The challenge in using common-sizing is interpreting the results. There are commonly more than one possible interpretation, and it takes experience and use of other data to determine the underlying causes. As but one example, lower EBITDA margins over time, combined with rising working capital as a percent of sales could indicate an increasingly competitive pricing environment, or a company’s willful easing of pricing and sales terms to capture market share. If EBITDA margins continue to be above industry average, the later interpretation is a positive. If EBITDA margins are at or below industry average, this would be considered a negative and would negatively impact company value.

You can use benchmarking to determine both your competiveness and salability, as well as a diagnostic tool to determine what needs to be changed (or not changed) about your company If your EBITDA margin is below industry average, common-sizing will quickly point to problems in your cost structure. After that, a re-engineering project is called for to ensure your supply chain is optimally designed.

One word of caution is in order. Your cost accounting and financial accounting have to be very good. Costs have to be accurately allocated. If you have multiple products, costs have to be allocated to each product. We commonly find that the quality of financial data of companies without audits is inadequate to make meaningful decisions. A re-engineering of the accounting and finance functions then become the first order of business. Without high quality cost accounting and financial accounting information, we are just flying blind.

If you are interested in benchmarking your own company or want to learn more about benchmarking using common-sized financial statements, please contact csmith@pegasusics.com.